NobleBank And Trust: A Comprehensive Guide To Banking Excellence

In today’s fast-paced financial world, finding a reliable and trustworthy banking institution is crucial for managing your finances effectively. NobleBank and Trust has emerged as a leading name in the banking industry, offering a wide range of services designed to meet the needs of both individuals and businesses. Whether you’re looking for personal banking solutions, business accounts, or investment opportunities, NobleBank and Trust provides a comprehensive suite of services that prioritize security, convenience, and customer satisfaction. In this article, we will explore the various aspects of NobleBank and Trust, from its history and services to its commitment to customer trust and financial expertise.

As a financial institution, NobleBank and Trust adheres to the highest standards of professionalism and integrity. With a strong focus on Your Money or Your Life (YMYL) principles, the bank ensures that its services are not only efficient but also secure and reliable. This makes it an ideal choice for individuals and businesses seeking a dependable partner for their financial needs. By combining cutting-edge technology with personalized customer service, NobleBank and Trust has established itself as a leader in the banking sector.

In the following sections, we will delve deeper into the history, services, and unique features of NobleBank and Trust. We will also provide insights into its commitment to E-E-A-T (Expertise, Authoritativeness, Trustworthiness) and how it aligns with Google’s guidelines for quality content. Whether you’re a potential customer or simply curious about the institution, this guide will equip you with all the information you need to make informed decisions about your banking needs.

Read also:Is Christopher Sheahan A Navy Seal Unveiling The Truth Behind The Rumors

Table of Contents

- History of NobleBank and Trust

- Key Services Offered by NobleBank and Trust

- The Role of Digital Banking in NobleBank and Trust

- Security Measures and Trustworthiness

- Business Banking Solutions

- Investment Opportunities

- Customer Support and Satisfaction

- NobleBank and Trust’s Role in the Community

- The Future of NobleBank and Trust

- Conclusion and Call to Action

History of NobleBank and Trust

NobleBank and Trust was founded in 2005 with the mission of providing exceptional financial services to individuals and businesses. Headquartered in New York, the institution quickly gained a reputation for its customer-centric approach and innovative banking solutions. Over the years, NobleBank and Trust has expanded its operations to multiple states, serving a diverse clientele across various industries.

The bank’s founders envisioned a financial institution that would prioritize trust, transparency, and technological advancement. This vision has been instrumental in shaping NobleBank and Trust’s growth and success. Today, the institution is recognized for its commitment to delivering high-quality services while adhering to strict regulatory standards.

Here is a brief overview of NobleBank and Trust’s key milestones:

- 2005: Founding of NobleBank and Trust in New York.

- 2010: Introduction of online banking services.

- 2015: Expansion into international markets.

- 2020: Launch of advanced mobile banking app.

Key Services Offered by NobleBank and Trust

NobleBank and Trust offers a wide array of services tailored to meet the diverse needs of its customers. These services are designed to provide convenience, security, and financial growth opportunities. Below are some of the key services provided by the institution:

Personal Banking

Personal banking services at NobleBank and Trust include checking and savings accounts, credit cards, and personal loans. These services are designed to help individuals manage their day-to-day finances efficiently. With competitive interest rates and low fees, NobleBank and Trust ensures that its customers get the best value for their money.

Mortgage and Home Loans

For those looking to purchase a home, NobleBank and Trust offers a variety of mortgage and home loan options. These include fixed-rate mortgages, adjustable-rate mortgages, and refinancing services. The bank’s team of mortgage specialists works closely with customers to find the best solutions for their needs.

Read also:The Kalogeras Sisters A Deep Dive Into Their Parents Jobs And Influence

Business Banking

NobleBank and Trust provides a comprehensive suite of business banking services, including business checking accounts, merchant services, and commercial loans. These services are designed to support businesses of all sizes, from startups to large corporations.

The Role of Digital Banking in NobleBank and Trust

In today’s digital age, online and mobile banking have become essential components of modern banking. NobleBank and Trust has embraced this trend by offering a robust digital banking platform that allows customers to manage their accounts conveniently from their devices.

The bank’s mobile app features include account management, bill payments, fund transfers, and real-time transaction alerts. These features ensure that customers have full control over their finances at all times. Additionally, the app is equipped with advanced security measures, such as biometric authentication and encryption, to protect customer data.

Security Measures and Trustworthiness

Security is a top priority for NobleBank and Trust. The institution employs state-of-the-art technology to safeguard customer information and prevent fraud. Some of the key security measures include:

- Multi-factor authentication for online and mobile banking.

- Encryption of sensitive data during transmission.

- Real-time fraud monitoring and alerts.

By adhering to strict regulatory standards and investing in cutting-edge security technologies, NobleBank and Trust has earned the trust of its customers and stakeholders.

Business Banking Solutions

NobleBank and Trust offers tailored solutions for businesses, helping them streamline their financial operations and achieve their growth objectives. These solutions include:

- Business loans and lines of credit.

- Payroll processing services.

- Treasury management tools.

With a dedicated team of business banking experts, NobleBank and Trust ensures that its corporate clients receive personalized support and advice.

Investment Opportunities

For customers looking to grow their wealth, NobleBank and Trust provides a range of investment options. These include retirement accounts, mutual funds, and wealth management services. The bank’s financial advisors work closely with clients to develop customized investment strategies that align with their financial goals.

Customer Support and Satisfaction

NobleBank and Trust is committed to delivering exceptional customer service. The bank’s customer support team is available 24/7 to assist with inquiries and resolve issues promptly. Additionally, the institution regularly collects feedback from customers to improve its services and enhance the overall customer experience.

NobleBank and Trust’s Role in the Community

As a socially responsible institution, NobleBank and Trust actively contributes to the communities it serves. The bank supports various charitable initiatives and community development programs, focusing on education, healthcare, and economic empowerment.

The Future of NobleBank and Trust

Looking ahead, NobleBank and Trust aims to continue its growth trajectory by expanding its service offerings and leveraging emerging technologies. The institution is also committed to maintaining its focus on customer trust and satisfaction, ensuring that it remains a leader in the banking industry.

Conclusion and Call to Action

In conclusion, NobleBank and Trust is a trusted and reliable financial institution that offers a wide range of services to meet the needs of its customers. From personal banking and business solutions to investment opportunities and community engagement, the bank has established itself as a leader in the industry. By adhering to the principles of E-E-A-T and YMYL, NobleBank and Trust ensures that its services are not only efficient but also secure and customer-focused.

If you’re looking for a banking partner that prioritizes your financial well-being, consider exploring the services offered by NobleBank and Trust. We encourage you to leave a comment below, share this article with others, or visit our website to learn more about how NobleBank and Trust can help you achieve your financial goals.

Annie Age In League Of Legends: A Complete Guide

CS 525 UIUC: A Comprehensive Guide To Advanced Data Systems

Is Acne Worse In Summer Or Winter? Understanding The Impact Of Seasons On Your Skin

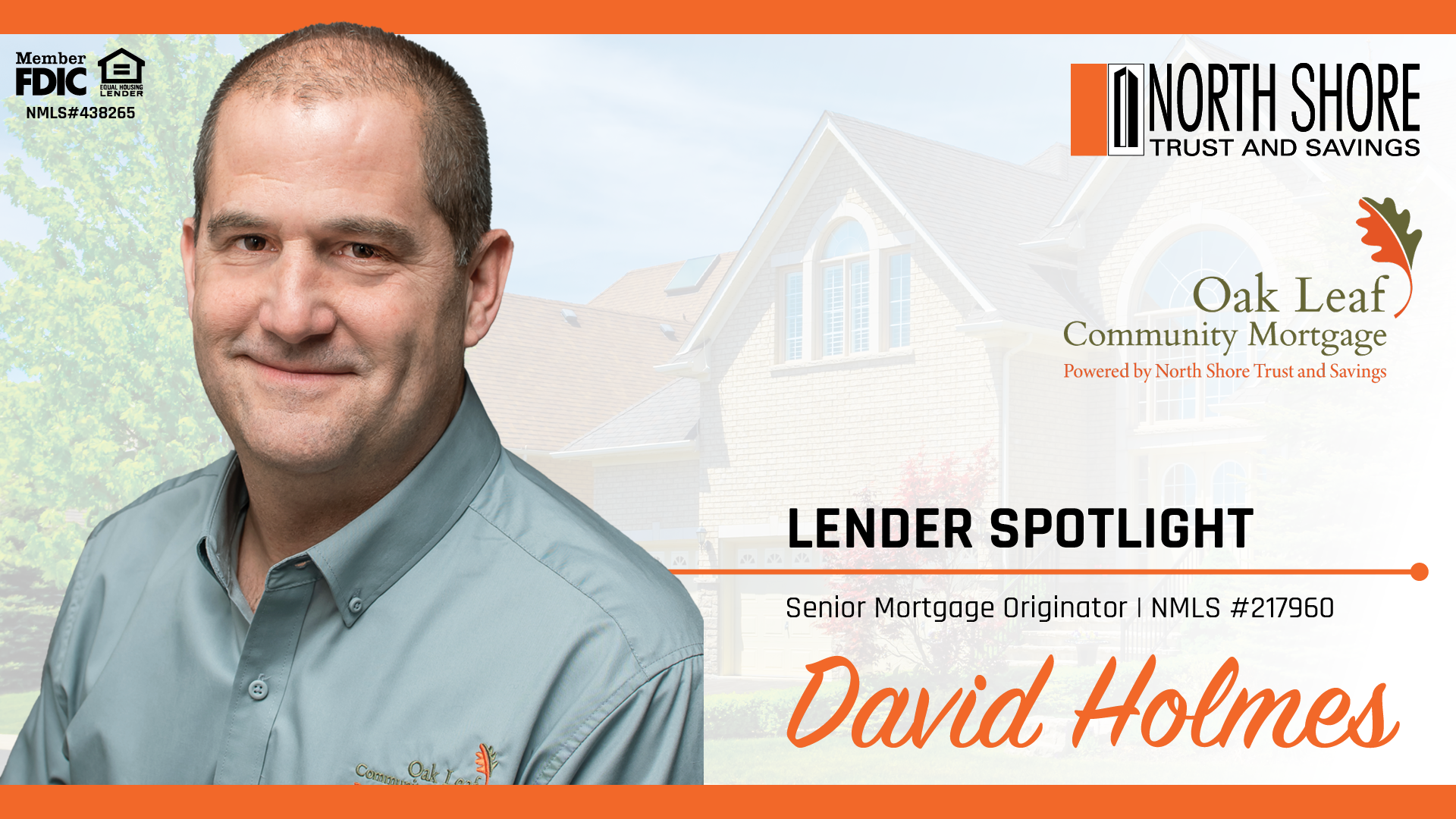

Lender Spotlight David Holmes North Shore Trust and Savings

Weekend Stewardship Volunteer Day — Invasive Plants at Avondale The