New York State Income Tax: A Comprehensive Guide For Taxpayers

New York State income tax is a critical aspect of financial planning for residents of the state. As one of the most populous and economically significant states in the U.S., New York has a complex tax system that requires careful attention from taxpayers. Whether you're a long-time resident or a newcomer, understanding the nuances of New York's income tax laws is essential for ensuring compliance and optimizing your financial strategy. In this article, we will delve deep into the intricacies of New York State income tax, covering everything from tax brackets and rates to deductions and credits.

New York's tax system is designed to generate revenue for essential public services such as education, healthcare, and infrastructure. The state's income tax plays a pivotal role in funding these initiatives, making it a YMYL (Your Money or Your Life) topic that directly impacts taxpayers' financial well-being. With varying tax rates based on income levels and filing statuses, navigating the New York State income tax landscape can be challenging without proper guidance.

In this comprehensive guide, we will explore the key components of New York State income tax, including how it works, who is required to pay, and strategies for minimizing your tax liability. By the end of this article, you'll have a clear understanding of your tax obligations and the tools necessary to make informed financial decisions. Whether you're filing your taxes for the first time or seeking ways to optimize your returns, this guide will serve as a valuable resource.

Read also:Empowering Lives The Free People Movement Revolution

Table of Contents

- How New York State Income Tax Works

- Understanding New York State Tax Brackets and Rates

- Filing Status and Its Impact on Your Taxes

- Key Deductions and Credits for New York Taxpayers

- Residency Rules and Their Implications

- Benefits of E-Filing Your New York State Tax Return

- Common Mistakes to Avoid When Filing

- Strategies for Effective Tax Planning

- Trusted Resources for New York Taxpayers

- Conclusion and Call to Action

How New York State Income Tax Works

New York State income tax operates on a progressive tax system, meaning that tax rates increase as income levels rise. This system ensures that individuals with higher incomes contribute a larger share of their earnings to state revenue. The tax is levied on various types of income, including wages, salaries, bonuses, and investment earnings. However, certain types of income, such as Social Security benefits, may be exempt or partially taxable depending on the taxpayer's circumstances.

Unlike federal income tax, which is uniform across the United States, New York State income tax is subject to state-specific rules and regulations. Taxpayers must file their state tax returns separately from their federal returns, adhering to deadlines and requirements set by the New York State Department of Taxation and Finance. Understanding the distinction between state and federal tax obligations is crucial for avoiding penalties and ensuring compliance.

Taxable vs. Non-Taxable Income

- Taxable Income: Includes wages, self-employment earnings, and investment income.

- Non-Taxable Income: May include certain retirement benefits, scholarships, and gifts.

Understanding New York State Tax Brackets and Rates

New York State employs a tiered tax bracket system, with rates ranging from 4% to 8.82% for the 2023 tax year. These brackets are determined based on filing status and taxable income. For example, single filers earning up to $8,500 are taxed at 4%, while those earning over $215,400 face the highest rate of 8.82%. Married couples filing jointly have different thresholds, with rates starting at 4% for incomes up to $17,150 and reaching 8.82% for incomes exceeding $323,200.

It's important to note that New York City and Yonkers impose additional income taxes, further increasing the tax burden for residents of these areas. For instance, New York City residents may face an additional tax rate of up to 3.876%, depending on their income level. Understanding these variations is essential for accurate tax planning and compliance.

2023 New York State Tax Brackets

| Filing Status | Income Range | Tax Rate |

|---|---|---|

| Single | Up to $8,500 | 4% |

| Single | $8,501 - $11,700 | 4.5% |

| Married Filing Jointly | Up to $17,150 | 4% |

Filing Status and Its Impact on Your Taxes

Your filing status significantly influences your New York State income tax liability. The state recognizes several filing statuses, including single, married filing jointly, married filing separately, and head of household. Each status has its own set of tax brackets and rates, which can affect the amount of tax you owe.

For example, married couples filing jointly often benefit from lower tax rates compared to those filing separately. However, this isn't always the case, as certain deductions and credits may be more advantageous for separate filers. It's essential to evaluate your financial situation carefully and consult with a tax professional if necessary to determine the most beneficial filing status for your circumstances.

Read also:The Happiest Season A Celebration Of Joy Love And Togetherness

Choosing the Right Filing Status

- Consider your marital status and household composition.

- Evaluate the impact of deductions and credits on your tax liability.

- Seek professional advice if unsure about the best filing option.

Key Deductions and Credits for New York Taxpayers

New York State offers a variety of deductions and credits to help taxpayers reduce their taxable income and overall tax liability. Some of the most significant deductions include contributions to retirement accounts, student loan interest, and mortgage interest. Additionally, taxpayers may qualify for credits such as the Earned Income Tax Credit (EITC), the Child and Dependent Care Credit, and the College Tuition Credit.

Understanding these deductions and credits can make a substantial difference in your tax bill. For instance, the EITC is designed to benefit low-to-moderate-income working individuals and families, providing a refundable credit that can significantly reduce tax liability or even result in a refund. Similarly, the College Tuition Credit offers relief to families paying for higher education expenses, making it an invaluable resource for many New York taxpayers.

Popular New York State Tax Credits

- Earned Income Tax Credit (EITC): Provides financial relief to low-income earners.

- Child and Dependent Care Credit: Helps cover childcare expenses for working parents.

- College Tuition Credit: Reduces the tax burden for families paying college tuition.

Residency Rules and Their Implications

New York State has specific residency rules that determine whether an individual is considered a resident for tax purposes. Residents are taxed on all income earned, regardless of where it was earned, while non-residents are only taxed on income derived from New York sources. There are two types of residency in New York: domicile and statutory residency.

Domicile refers to your permanent home, while statutory residency applies to individuals who spend more than 183 days in the state during a tax year, regardless of their domicile. Understanding these distinctions is crucial for accurately determining your tax obligations and avoiding potential penalties for underpayment or non-compliance.

Residency Determination Checklist

- Do you maintain a permanent home in New York?

- Have you spent more than 183 days in the state during the tax year?

- Do you have significant ties to New York, such as employment or property ownership?

Benefits of E-Filing Your New York State Tax Return

E-filing your New York State tax return offers numerous advantages, including faster processing times, reduced errors, and quicker refunds. The New York State Department of Taxation and Finance provides a user-friendly e-filing system that simplifies the tax filing process for individuals and businesses alike. By choosing to e-file, taxpayers can ensure that their returns are submitted accurately and efficiently, minimizing the risk of delays or audits.

In addition to convenience, e-filing also provides enhanced security features to protect sensitive financial information. Taxpayers can track the status of their returns in real-time and receive confirmation once their submission has been processed. For those who prefer professional assistance, many tax preparers offer e-filing services as part of their packages, ensuring compliance with state regulations.

Steps to E-File Your Tax Return

- Gather all necessary tax documents, including W-2s and 1099s.

- Choose an approved e-filing platform or tax preparer.

- Complete and submit your tax return electronically.

Common Mistakes to Avoid When Filing

Filing taxes can be a complex process, and even minor errors can lead to significant consequences, including penalties and audits. Some of the most common mistakes made by New York State taxpayers include failing to report all income, miscalculating deductions, and missing filing deadlines. To avoid these pitfalls, it's essential to double-check your return for accuracy and completeness before submission.

Another frequent error is neglecting to take advantage of available deductions and credits. Many taxpayers overlook opportunities to reduce their tax liability, resulting in higher-than-necessary payments. Staying informed about changes to tax laws and consulting with a tax professional can help ensure that you maximize your benefits and minimize your tax burden.

Checklist to Avoid Common Errors

- Verify that all income sources are reported accurately.

- Review deductions and credits for eligibility.

- Submit your return before the deadline to avoid penalties.

Strategies for Effective Tax Planning

Effective tax planning is essential for optimizing your financial situation and minimizing your New York State income tax liability. One of the most effective strategies is to contribute to tax-advantaged accounts, such as IRAs and 401(k)s, which allow you to reduce your taxable income while saving for retirement. Additionally, timing your income and expenses strategically can help you stay within lower tax brackets and maximize deductions.

Another key strategy is to stay informed about changes to tax laws and regulations. New York State frequently updates its tax policies, and staying up-to-date ensures that you remain compliant and take advantage of new opportunities. Working with a certified tax professional or financial advisor can provide valuable insights and guidance tailored to your unique circumstances.

Tax Planning Tips

- Contribute to retirement accounts to reduce taxable income.

- Time income and expenses to optimize tax brackets.

- Stay informed about changes to New York State tax laws.

Trusted Resources for New York Taxpayers

For taxpayers seeking reliable information about New York State income tax, several trusted resources are available. The New York State Department of Taxation and Finance website provides comprehensive guides, forms, and FAQs to assist taxpayers in understanding their obligations. Additionally, organizations such as the IRS and local tax advocacy groups offer valuable resources and support for navigating the tax system.

For personalized assistance, consulting with a certified public accountant (CPA) or tax attorney can provide tailored advice and ensure compliance with state regulations. These professionals can help you identify deductions and credits, plan for future tax liabilities, and resolve any issues that may arise during the filing process.

Recommended Resources

- New York State Department of Taxation and Finance

- Internal Revenue Service (IRS)

- Local CPA firms and tax advisory services.

Conclusion and Call to Action

Understanding Arrest.org: A Comprehensive Guide To Legal Resources And Support

January 20 Zodiac: Unveiling The Secrets Of Your Astrological Sign

Jean-Bernard Fernandez-Versini: A Comprehensive Guide To His Life And Career

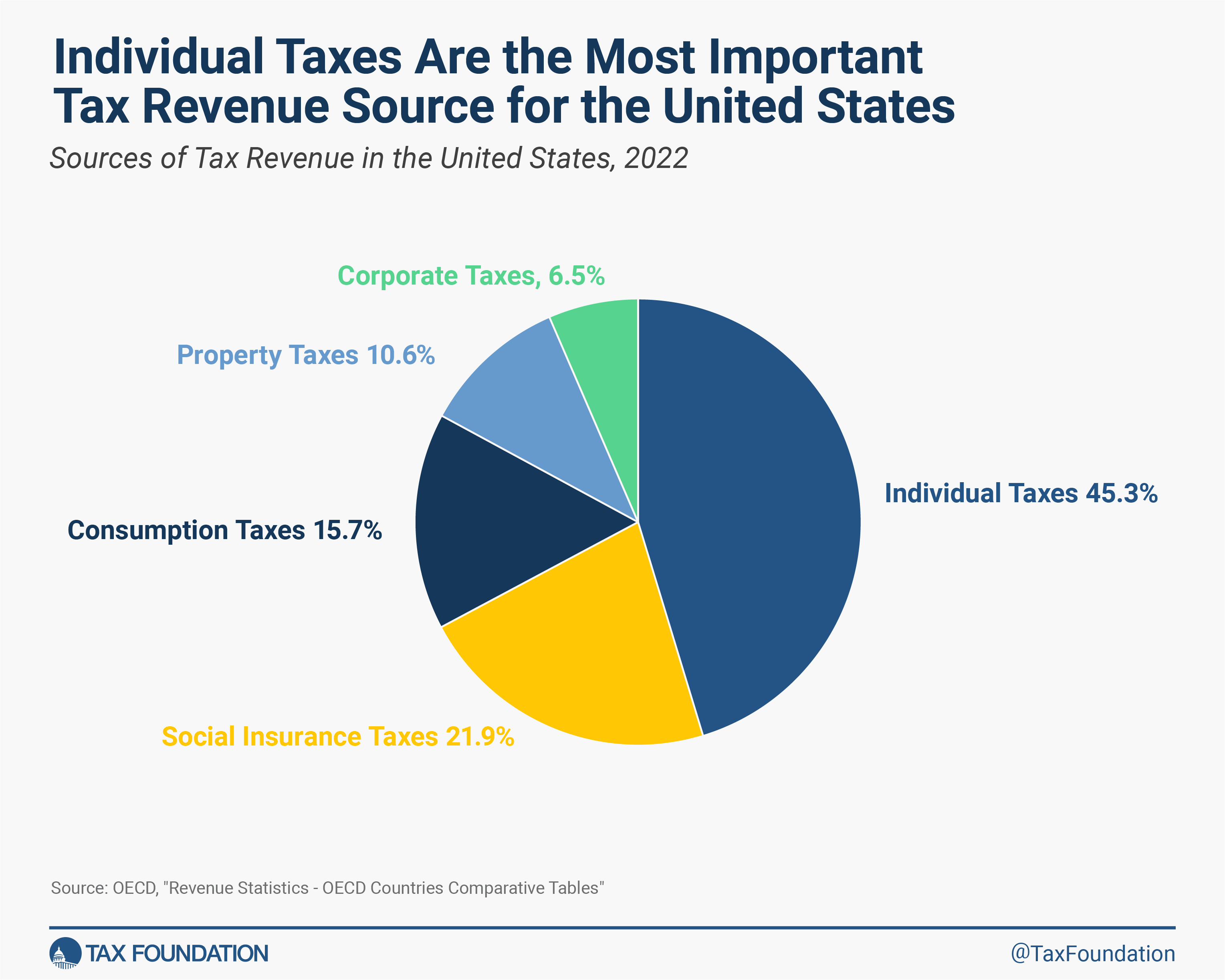

US Tax by Tax Sort, 2024 Replace BitWolf

Tax Brackets Nz 2024 Chlo