Voyage FCU Credit Card: Unlocking Financial Freedom And Travel Rewards

Are you looking for a credit card that offers exceptional travel rewards, low fees, and financial flexibility? The Voyage FCU Credit Card might be the perfect solution for you. In today’s fast-paced world, managing finances while enjoying the perks of travel has become a priority for many. This article dives deep into the features, benefits, and considerations of the Voyage FCU Credit Card, ensuring you have all the information you need to make an informed decision. Whether you're a frequent traveler, a financial enthusiast, or someone who simply wants to maximize their credit card benefits, this guide is tailored to help you understand why this card could be a game-changer for your lifestyle.

Credit cards are more than just a tool for making purchases; they are a gateway to financial opportunities and rewards. The Voyage FCU Credit Card stands out in the crowded market of credit cards due to its unique offerings and member-centric approach. From cashback rewards to travel perks, this card is designed to cater to individuals who value both financial stability and travel convenience. In this article, we’ll explore everything you need to know about the Voyage FCU Credit Card, including its features, eligibility requirements, and how it compares to other credit cards on the market.

As we delve deeper into this topic, you'll discover why the Voyage FCU Credit Card is a popular choice among credit card users. By the end of this article, you’ll have a comprehensive understanding of how this card can enhance your financial journey and travel experiences. So, buckle up and get ready to explore the world of financial freedom and travel rewards with the Voyage FCU Credit Card.

Read also:Travis Scott Girlfriend 2025 Everything You Need To Know About His Love Life

Table of Contents

What is the Voyage FCU Credit Card?

The Voyage FCU Credit Card is a financial product offered by Voyage Federal Credit Union (FCU), a member-focused financial institution dedicated to providing affordable banking solutions. Designed to cater to both everyday spenders and frequent travelers, this card combines the convenience of a credit card with the added benefits of travel rewards and financial flexibility. Whether you're booking a flight, dining out, or shopping online, the Voyage FCU Credit Card ensures you earn rewards on every purchase.

Overview of Voyage FCU

Voyage FCU is a federally insured credit union that prioritizes its members' financial well-being. Unlike traditional banks, credit unions like Voyage FCU operate as not-for-profit organizations, meaning their primary goal is to serve their members rather than generate profits. This member-centric approach allows Voyage FCU to offer competitive interest rates, lower fees, and personalized services. The Voyage FCU Credit Card is one of their flagship products, designed to provide members with a seamless blend of financial tools and travel rewards.

Why Choose the Voyage FCU Credit Card?

There are several reasons why the Voyage FCU Credit Card stands out in the market. First and foremost, it offers a unique combination of travel rewards and financial benefits. Members can earn points for every dollar spent, which can later be redeemed for travel-related expenses such as flights, hotels, and car rentals. Additionally, the card comes with a low annual fee, making it an affordable option for those looking to maximize their rewards without breaking the bank.

- Earn points for every purchase

- Redeem points for travel rewards

- Low annual fee

- No foreign transaction fees

- Access to exclusive member benefits

Key Features and Benefits

The Voyage FCU Credit Card is packed with features that make it an attractive option for both new and experienced credit card users. Below, we’ll explore some of the standout features and benefits that set this card apart from its competitors.

Reward Program

One of the most appealing aspects of the Voyage FCU Credit Card is its robust reward program. Cardholders earn points for every dollar spent, which can be redeemed for a variety of travel-related expenses. The points system is straightforward and easy to understand, ensuring that members can maximize their rewards without any hassle. Additionally, the card offers bonus points for specific categories such as dining, travel, and groceries, making it even more rewarding for everyday use.

Travel Benefits

Travel enthusiasts will appreciate the card's travel perks, which include access to exclusive discounts on flights, hotels, and car rentals. The card also offers travel insurance, roadside assistance, and concierge services, providing peace of mind for travelers. Furthermore, there are no foreign transaction fees, making it an ideal choice for international travel.

Read also:Wasmo Telegram Link 2024 Ultimate Guide To Access Safety And Usage

Financial Flexibility

In addition to its travel rewards, the Voyage FCU Credit Card offers financial flexibility through its low interest rates and customizable payment options. Members can choose from various repayment plans, allowing them to manage their finances more effectively. The card also includes tools such as budgeting apps and spending alerts to help users stay on track with their financial goals.

Eligibility and Application Process

Before applying for the Voyage FCU Credit Card, it's important to understand the eligibility requirements and application process. This ensures that you meet the necessary criteria and can complete the application smoothly.

Eligibility Requirements

To qualify for the Voyage FCU Credit Card, applicants must meet the following criteria:

- Be at least 18 years old

- Have a valid Social Security number

- Be a member of Voyage FCU (membership is open to individuals who live, work, or worship in designated areas)

- Have a stable source of income

Application Process

The application process for the Voyage FCU Credit Card is straightforward and can be completed online or in person. Applicants will need to provide personal information such as their name, address, income, and Social Security number. Once the application is submitted, it typically takes 7-10 business days for approval. Upon approval, the card will be mailed to the applicant's address.

How to Maximize Rewards

Maximizing rewards with the Voyage FCU Credit Card requires a strategic approach. By understanding how the rewards program works and leveraging the card's features, you can earn significant benefits over time.

Strategic Spending

To maximize your rewards, focus on spending in categories that offer bonus points. For example, using the card for dining and travel expenses can help you earn more points faster. Additionally, taking advantage of promotional offers and special deals can further boost your rewards.

Redeeming Points

When redeeming points, consider using them for high-value rewards such as flights and hotel stays. This ensures that you get the most bang for your buck. It's also a good idea to keep track of your points balance and expiration dates to avoid losing any unused rewards.

Fees and Interest Rates

Understanding the fees and interest rates associated with the Voyage FCU Credit Card is crucial for managing your finances effectively. While the card offers several benefits, it's important to be aware of the costs involved.

Annual Fee

The Voyage FCU Credit Card has a low annual fee, making it an affordable option for most users. However, it's important to weigh the annual fee against the rewards and benefits to determine if the card is worth it for your lifestyle.

Interest Rates

The card offers competitive interest rates, which can vary based on the applicant's credit score. By maintaining a good credit score and making timely payments, you can qualify for lower interest rates and save money in the long run.

Comparison with Other Credit Cards

When choosing a credit card, it's important to compare it with other options on the market. Below, we’ll compare the Voyage FCU Credit Card with some of its competitors to help you make an informed decision.

Voyage FCU vs. Chase Sapphire Preferred

While both cards offer travel rewards, the Chase Sapphire Preferred has a higher annual fee but provides additional perks such as lounge access and travel credits. On the other hand, the Voyage FCU Credit Card is more affordable and offers no foreign transaction fees, making it a better choice for budget-conscious travelers.

Voyage FCU vs. Capital One Venture

The Capital One Venture card offers a similar rewards program but comes with a higher annual fee. The Voyage FCU Credit Card, with its lower fees and member-centric approach, is a more cost-effective option for those looking to maximize their travel rewards.

Travel Perks and Benefits

The Voyage FCU Credit Card is packed with travel perks that make it a top choice for frequent travelers. From travel insurance to exclusive discounts, this card offers a wide range of benefits to enhance your travel experience.

Travel Insurance

Cardholders enjoy complimentary travel insurance, which covers trip cancellations, interruptions, and delays. This provides peace of mind for travelers and ensures that their trips are protected against unforeseen circumstances.

Exclusive Discounts

Members can access exclusive discounts on flights, hotels, and car rentals through the card's travel portal. These discounts can help you save money on your travel expenses and make your trips more affordable.

Financial Security and Protection

In addition to its travel perks, the Voyage FCU Credit Card offers robust financial security and protection features. These include fraud protection, zero liability, and identity theft resolution services.

Fraud Protection

The card includes advanced fraud protection measures to safeguard your account from unauthorized transactions. If any suspicious activity is detected, you'll be notified immediately, ensuring that your finances remain secure.

Identity Theft Resolution

In the event of identity theft, cardholders have access to identity theft resolution services. These services provide step-by-step guidance to help you recover your identity and restore your financial standing.

Member Reviews and Testimonials

Don't just take our word for it—here's what actual members have to say about the Voyage FCU Credit Card:

- "I love how easy it is to earn and redeem points with this card. The travel perks are amazing!" – Sarah T.

- "The low annual fee and no foreign transaction fees make this card perfect for international travel." – James L.

- "Voyage FCU's customer service is top-notch. They helped me resolve an issue quickly and efficiently." – Emily R.

Conclusion and Call to Action

In conclusion, the Voyage FCU Credit Card is a versatile and rewarding option for individuals seeking financial flexibility and travel perks. With its low fees, robust reward program, and member-centric approach, this card stands out as a top choice in the crowded credit card market. Whether you're a frequent traveler or simply looking to maximize your rewards, the Voyage FCU Credit Card has something to offer for everyone.

We encourage you to apply for the Voyage FCU Credit Card today and start enjoying the benefits it has to offer. Don't forget to share your experiences with us in the comments below or reach out if you have any questions. Happy travels and happy spending!

Dan Broderick Linda: A Comprehensive Guide To Their Journey And Impact

FL Driver's License Renewal: A Complete Guide To Renewing Your License In Florida

Twilight Wedding: A Magical Celebration Under The Stars

Voyage FCU Awarded 1500 in Scholarships at our Annual Meeting — Voyage

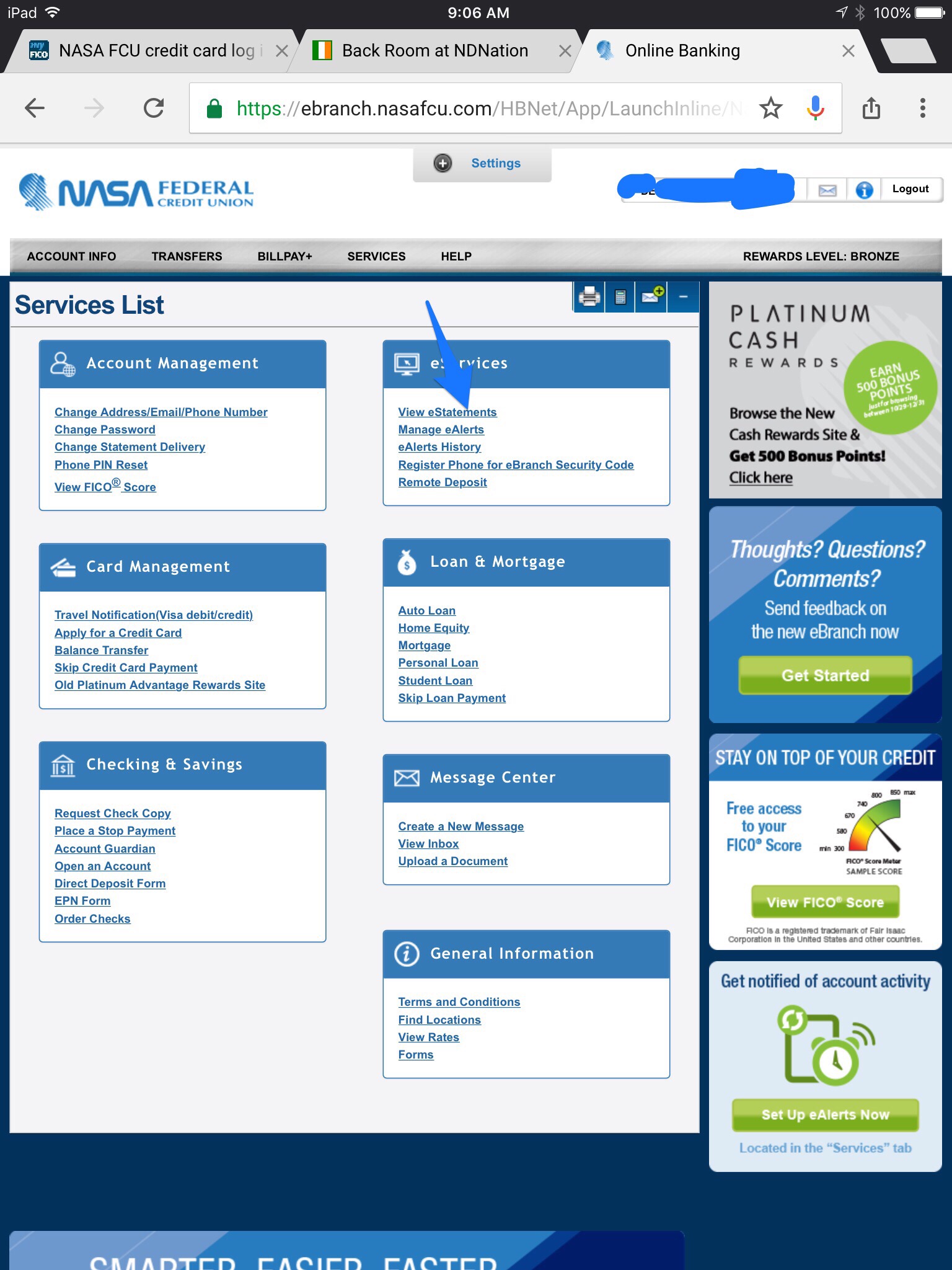

NASA FCU credit card log in... myFICO® Forums 4782987