Alex Kleyner National Debt Relief: A Comprehensive Guide To Managing Your Financial Future

Are you struggling with overwhelming debt and searching for a reliable solution? Alex Kleyner National Debt Relief might be the answer you’ve been looking for. In today’s uncertain financial landscape, managing debt can feel like an impossible task. However, with the right guidance and expertise, achieving financial freedom is within reach. This article dives deep into the world of Alex Kleyner and National Debt Relief, providing you with the tools and insights you need to take control of your financial future.

National Debt Relief has become a trusted name in the debt management industry, and Alex Kleyner is one of its prominent figures. Known for his expertise in financial strategies and consumer advocacy, Kleyner has helped countless individuals and families navigate the complexities of debt settlement. Whether you’re dealing with credit card debt, medical bills, or other financial burdens, understanding how National Debt Relief operates under leaders like Alex Kleyner can make a significant difference in your journey toward financial stability.

In this comprehensive guide, we’ll explore the role of Alex Kleyner in National Debt Relief, how the company works, and what you need to know before enrolling in their programs. We’ll also provide actionable tips and insights to help you make informed decisions about your financial health. By the end of this article, you’ll have a clear understanding of how Alex Kleyner and National Debt Relief can help you regain control of your finances.

Read also:Pedernales Falls State Park A Natural Haven In Texas

Table of Contents

- Biography of Alex Kleyner

- An Overview of National Debt Relief

- Services Offered by National Debt Relief

- How the Debt Relief Process Works

- Benefits of Working with National Debt Relief

- Challenges and Considerations

- Customer Testimonials and Success Stories

- Alternatives to National Debt Relief

- Key Statistics on Debt in the U.S.

- Conclusion and Call to Action

Biography of Alex Kleyner

Alex Kleyner is a respected figure in the financial services industry, particularly in the realm of debt relief. With years of experience in consumer advocacy and financial planning, Kleyner has dedicated his career to helping individuals and families overcome financial challenges. His leadership at National Debt Relief has been instrumental in shaping the company’s mission and approach to debt management.

Below is a table summarizing Alex Kleyner’s key personal and professional details:

| Full Name | Alex Kleyner |

|---|---|

| Position | Executive Leader at National Debt Relief |

| Years of Experience | Over 15 years in financial services |

| Area of Expertise | Debt settlement, consumer advocacy, financial planning |

| Education | Bachelor’s Degree in Finance (Institution Name) |

| Notable Achievements | Recipient of multiple awards for leadership in financial services |

An Overview of National Debt Relief

National Debt Relief is a leading provider of debt settlement services, helping individuals and families reduce their financial burdens through strategic negotiations with creditors. Founded in 2009, the company has grown to become one of the most trusted names in the industry, with a reputation for transparency and customer-centric solutions.

Company Mission and Values

The mission of National Debt Relief is to empower individuals to achieve financial freedom by offering personalized debt relief solutions. The company operates on core values such as integrity, transparency, and accountability, ensuring that clients receive ethical and effective services.

How Alex Kleyner Contributes to the Company’s Success

As a key leader at National Debt Relief, Alex Kleyner plays a pivotal role in shaping the company’s strategies and ensuring that its services align with the needs of its clients. His expertise in consumer advocacy and financial planning has been instrumental in building trust and credibility for the company.

Services Offered by National Debt Relief

National Debt Relief offers a range of services designed to help individuals manage and reduce their debt. These services include:

Read also:Robot Chicken A Deep Dive Into The Cult Classic Comedy Show

- Debt Settlement: Negotiating with creditors to reduce the total amount owed.

- Debt Management Plans: Creating structured repayment plans to pay off debt over time.

- Financial Education: Providing resources and tools to improve financial literacy.

- Credit Counseling: Offering personalized advice to help clients make informed financial decisions.

Why Choose National Debt Relief?

National Debt Relief stands out from other debt relief companies due to its commitment to transparency, ethical practices, and customer satisfaction. The company has received numerous accolades for its services, including recognition from the Better Business Bureau (BBB) and other industry organizations.

How the Debt Relief Process Works

The debt relief process at National Debt Relief involves several key steps, each designed to help clients achieve their financial goals. Here’s an overview of how the process works:

Step 1: Initial Consultation

Clients begin by scheduling a free consultation with a debt relief specialist. During this consultation, the specialist will assess the client’s financial situation, including their total debt, income, and expenses.

Step 2: Customized Debt Relief Plan

Based on the assessment, the specialist will create a personalized debt relief plan tailored to the client’s needs. This plan may include debt settlement, debt management, or a combination of strategies.

Step 3: Negotiation with Creditors

Once the plan is approved, National Debt Relief will negotiate with creditors on behalf of the client to reduce the total amount owed. This step often results in significant savings for the client.

Step 4: Debt Repayment

After successful negotiations, the client will begin repaying the reduced debt amount according to the agreed-upon terms. National Debt Relief provides ongoing support throughout this process to ensure a smooth experience.

Benefits of Working with National Debt Relief

There are several advantages to choosing National Debt Relief for your debt management needs:

- Expert Guidance: Clients receive support from experienced debt relief specialists.

- Customized Solutions: Each plan is tailored to the client’s unique financial situation.

- Transparent Fees: The company provides clear information about its fees and services.

- Proven Track Record: National Debt Relief has helped thousands of clients achieve financial freedom.

Challenges and Considerations

While National Debt Relief offers many benefits, it’s important to be aware of potential challenges and considerations:

Possible Impact on Credit Score

Debt settlement can have a temporary negative impact on your credit score. However, many clients find that the long-term benefits outweigh this short-term effect.

Fees and Costs

National Debt Relief charges fees for its services, which are typically a percentage of the debt amount. Clients should carefully review these fees before enrolling in a program.

Time Commitment

The debt relief process can take several months to complete, depending on the complexity of the case and the client’s financial situation.

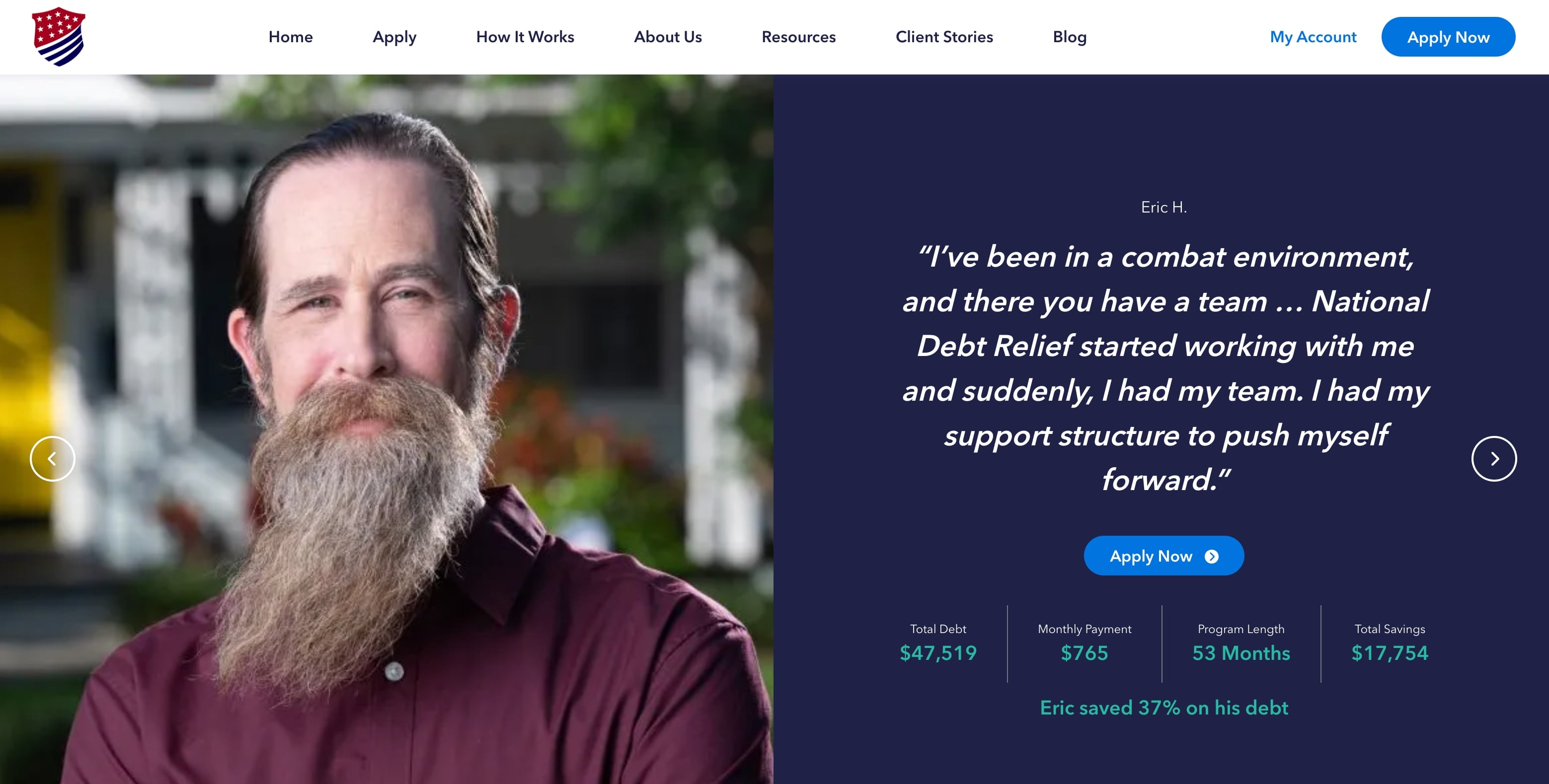

Customer Testimonials and Success Stories

Many clients have shared their success stories after working with National Debt Relief. These testimonials highlight the company’s effectiveness in helping individuals overcome financial challenges.

Case Study: Sarah’s Journey to Financial Freedom

Sarah, a single mother from Ohio, was struggling with $45,000 in credit card debt. After enrolling in National Debt Relief’s program, she was able to reduce her debt by 50% and pay it off within two years. “I couldn’t have done it without their support and guidance,” Sarah says.

Alternatives to National Debt Relief

While National Debt Relief is a popular choice, there are other options available for individuals seeking debt management solutions:

- Debt Consolidation Loans: Combining multiple debts into a single loan with a lower interest rate.

- Credit Counseling Agencies: Non-profit organizations that provide financial education and debt management plans.

- Bankruptcy: A legal process for discharging or restructuring debt, though it has long-term consequences.

Key Statistics on Debt in the U.S.

Understanding the broader context of debt in the United States can help individuals make informed decisions about their financial health. Here are some key statistics:

- As of 2023, total household debt in the U.S. exceeds $16 trillion.

- The average credit card debt per household is approximately $6,000.

- Over 40% of Americans report struggling with debt.

Conclusion and Call to Action

Alex Kleyner and National Debt Relief offer a lifeline to individuals and families burdened by overwhelming debt. With a proven track record of success, transparent practices, and personalized solutions, the company has earned its reputation as a leader in the debt relief industry. Whether you’re considering debt settlement, credit counseling, or other financial strategies, National Debt Relief can provide the guidance and support you need to achieve financial freedom.

If you’re ready to take the first step toward a debt-free future, we encourage you to schedule a consultation with National Debt Relief. Additionally, feel free to share your thoughts or questions in the comments section below. Your financial journey starts today!

Discover The Wonders Of Aviary Philadelphia: A Haven For Bird Enthusiasts

Joey Diaz Family: A Deep Dive Into His Personal Life And Background

Rihanna Funko Pop: A Must-Have Collectible For Fans

Alex Kleyner Wife Journey, Challenges, and Successes Uplink Post

National Debt Relief — Expert Debt Relief Solutions, Today National