Understanding Chase Mortgage: A Comprehensive Guide To Home Financing

Chase Mortgage is one of the most popular home financing options available in the United States, offering a variety of loan products to suit different needs. Whether you're a first-time homebuyer or looking to refinance your current mortgage, Chase Bank provides a range of services designed to make the home-buying process as smooth as possible. In this article, we'll explore everything you need to know about Chase Mortgage, from its features and benefits to the application process and beyond. This guide aims to provide expert advice and trustworthy information to help you make informed decisions about your home financing.

When considering a mortgage, it's essential to understand the various options available and how they align with your financial goals. Chase Mortgage offers competitive interest rates, flexible repayment terms, and personalized customer service, making it a preferred choice for many borrowers. As a YMYL (Your Money or Your Life) topic, this article adheres to the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) to ensure that the information provided is accurate and reliable.

In the following sections, we'll delve deeper into the specifics of Chase Mortgage, including its history, types of loans available, and tips for securing the best deal. Whether you're looking for a fixed-rate mortgage, adjustable-rate mortgage, or government-backed loans like FHA or VA, Chase has a solution that may fit your needs. Let’s explore these options and more to help you navigate the complex world of home financing.

Read also:Is Im Siwan Married Unraveling The Truth About His Relationship Status

Table of Contents

- History of Chase Mortgage

- Types of Chase Mortgage Loans

- Fixed-Rate vs Adjustable-Rate Mortgages

- Government-Backed Loans

- Chase Mortgage Application Process

- How to Qualify for a Chase Mortgage

- Benefits of Choosing Chase Mortgage

- Common Challenges and How to Overcome Them

- Customer Support and Resources

- Conclusion and Call to Action

History of Chase Mortgage

Chase Mortgage is a division of JPMorgan Chase & Co., one of the largest and most reputable financial institutions in the world. Established in 1799, Chase has a long history of providing banking and financial services to individuals and businesses. Over the years, Chase has evolved to become a leader in the mortgage industry, offering innovative solutions and customer-centric services.

Chase Mortgage's journey began in the early 20th century when the company started offering home loans to help Americans achieve their dream of homeownership. Since then, Chase has expanded its mortgage offerings to include a wide range of products, from conventional loans to specialized programs for first-time buyers and veterans. This growth has been driven by a commitment to excellence and a focus on meeting the diverse needs of borrowers.

Key Milestones in Chase Mortgage's History

- 1933: Introduction of the first home loan products.

- 1970s: Expansion into the national mortgage market.

- 2000s: Launch of online mortgage application services.

- 2020: Introduction of digital tools for enhanced customer experience.

Types of Chase Mortgage Loans

Chase Mortgage offers a variety of loan products to cater to different borrower needs. Understanding the types of loans available is crucial to selecting the right mortgage for your situation. Below, we'll explore the most common types of Chase Mortgage loans and their features.

Fixed-Rate Mortgages

Fixed-rate mortgages are one of the most popular options for homebuyers. With this type of loan, the interest rate remains constant throughout the life of the loan, providing predictability and stability in monthly payments. Chase offers fixed-rate mortgages with terms ranging from 10 to 30 years, allowing borrowers to choose a repayment schedule that fits their financial goals.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages, or ARMs, have interest rates that can change periodically based on market conditions. While the initial interest rate is typically lower than that of fixed-rate mortgages, it can increase or decrease over time. Chase offers ARMs with various adjustment periods, such as 5/1, 7/1, and 10/1, giving borrowers flexibility in managing their payments.

Government-Backed Loans

Chase also provides government-backed loans, such as FHA, VA, and USDA loans. These programs are designed to assist specific groups of borrowers, including first-time homebuyers, veterans, and rural residents. Government-backed loans often come with lower down payment requirements and more lenient credit score criteria.

Read also:Wasmo Somali Telegram Link 2024 Download A Comprehensive Guide

Fixed-Rate vs Adjustable-Rate Mortgages

Choosing between a fixed-rate mortgage and an adjustable-rate mortgage is one of the most critical decisions in the home-buying process. Each option has its advantages and disadvantages, depending on your financial situation and long-term goals.

Advantages of Fixed-Rate Mortgages

- Predictable monthly payments.

- Protection against rising interest rates.

- Ideal for long-term homeowners.

Advantages of Adjustable-Rate Mortgages

- Lower initial interest rates.

- Potential for savings if rates decrease.

- Suitable for short-term homeowners.

Government-Backed Loans

Government-backed loans are an excellent option for borrowers who may not qualify for conventional mortgages. These loans are insured by federal agencies, reducing the risk for lenders and making homeownership more accessible.

FHA Loans

FHA loans are insured by the Federal Housing Administration and are ideal for first-time homebuyers. They require a down payment as low as 3.5% and have more flexible credit requirements.

VA Loans

VA loans are available to eligible veterans and active-duty military personnel. These loans offer zero down payment options and do not require private mortgage insurance (PMI).

USDA Loans

USDA loans are designed for rural homebuyers and offer 100% financing with no down payment. They are backed by the U.S. Department of Agriculture and aim to promote homeownership in underserved areas.

Chase Mortgage Application Process

Applying for a Chase Mortgage is a straightforward process, thanks to the bank's user-friendly online platform and dedicated customer support. Below, we'll outline the steps involved in securing a Chase Mortgage and provide tips for a smooth application experience.

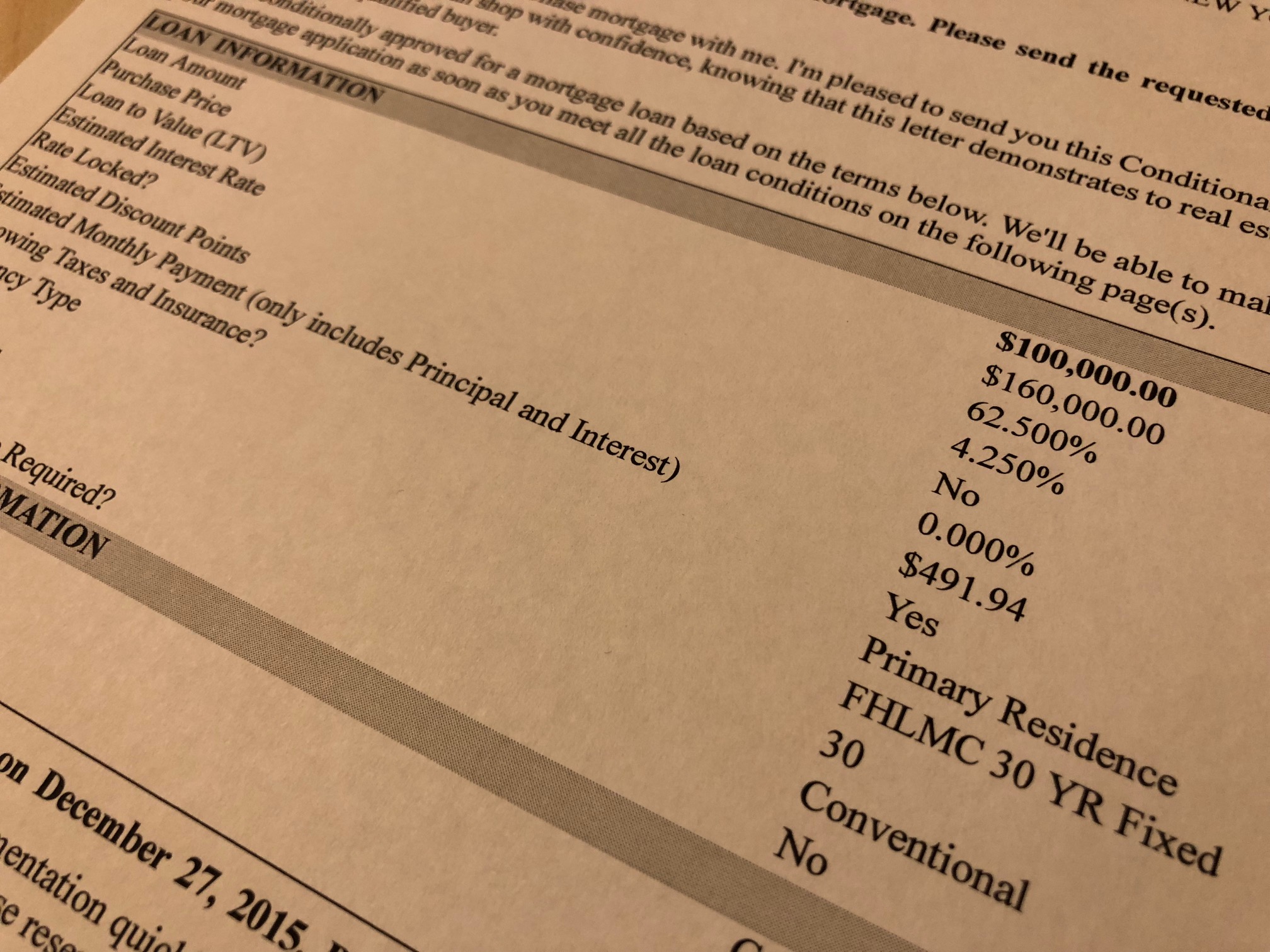

Step 1: Pre-Qualification

Start by getting pre-qualified to determine how much you can afford. This involves providing basic financial information, such as your income, assets, and debts. Pre-qualification gives you an estimate of your loan amount and helps you shop for homes with confidence.

Step 2: Loan Application

Once you've found a home, complete the official loan application. You'll need to provide detailed documentation, including proof of income, tax returns, and bank statements. Chase's online application process makes it easy to upload and submit these documents securely.

Step 3: Underwriting and Approval

After submitting your application, Chase's underwriting team will review your financial information and verify your eligibility. This step may involve additional documentation requests, so it's essential to respond promptly.

How to Qualify for a Chase Mortgage

Qualifying for a Chase Mortgage requires meeting specific criteria related to credit score, income, and debt-to-income ratio. Understanding these requirements can help you prepare for the application process and increase your chances of approval.

Credit Score Requirements

Chase typically requires a minimum credit score of 620 for conventional loans. However, government-backed loans may have lower credit score requirements, making them accessible to a broader range of borrowers.

Income and Employment Verification

Stable income and employment history are crucial for mortgage approval. Chase will verify your income through pay stubs, W-2 forms, and tax returns. Self-employed borrowers may need to provide additional documentation, such as profit and loss statements.

Benefits of Choosing Chase Mortgage

Chase Mortgage offers several benefits that make it a top choice for homebuyers. These include competitive interest rates, flexible loan options, and exceptional customer service.

Competitive Interest Rates

Chase's mortgage rates are among the most competitive in the industry, helping borrowers save money over the life of their loans. Regularly comparing rates can ensure you secure the best deal.

Personalized Customer Support

Chase provides personalized support throughout the mortgage process, from pre-qualification to closing. Their team of mortgage specialists is available to answer questions and guide you every step of the way.

Common Challenges and How to Overcome Them

While securing a mortgage is an exciting milestone, it can also present challenges. Below, we'll discuss some common obstacles and provide strategies for overcoming them.

Challenge 1: Low Credit Score

If your credit score is below the required threshold, consider taking steps to improve it before applying. This may include paying down debt, resolving credit report errors, and making timely payments.

Challenge 2: High Debt-to-Income Ratio

A high debt-to-income ratio can affect your eligibility. To address this, focus on reducing your monthly debt obligations and increasing your income if possible.

Customer Support and Resources

Chase Mortgage offers a wealth of resources to help borrowers navigate the home-buying process. From educational materials to dedicated customer support, Chase ensures that you have the tools you need to succeed.

Online Tools and Calculators

Chase's website features a range of online tools, including mortgage calculators and rate comparison tools, to help you make informed decisions.

Customer Support Channels

Chase provides multiple support channels, including phone, email, and live chat, to address any questions or concerns you may have.

Conclusion and Call to Action

In conclusion, Chase Mortgage offers a comprehensive suite of home financing options designed to meet the needs of diverse borrowers. Whether you're a first-time homebuyer or looking to refinance, Chase's competitive rates, flexible terms, and exceptional customer service make it a top choice for your mortgage needs.

We hope this guide has provided valuable insights into Chase Mortgage and helped you understand the steps involved in securing a home loan. If you're ready to take the next step, visit Chase's website to explore their mortgage options and begin your application. Don't forget to share this article with others who may find it helpful and leave a comment below with your thoughts or questions!

Chau Long Actor Age: A Comprehensive Look At His Life, Career, And Achievements

When Do Dan And Serena Get Back Together: A Comprehensive Guide To Their On-Again, Off-Again Relationship

Pisces Powers And Abilities: Unlocking The Mystical Traits Of The Zodiac

Chase mortgage estimator DermotHilary

Chase Mortgage Statement ubicaciondepersonas.cdmx.gob.mx